Taxes on gasoline effectively reduce CO2 emissions, yet they are lower now than they were 13 years ago, finds a new study.

By increasing taxes and removing subsidies for fossil fuels, governments provide an incentive for consumers to start using cleaner alternatives. However, this mechanism is not being put to full use, say US scientists, who have published their work in the journal Nature Energy.

While some countries have consistently removed subsidies on fossil fuels, the overall trend between 2003 and 2015 was for lower taxes, the study says.

Lack of clarity

The removal of subsidies is a high-profile issue when it comes to tackling climate change.

Last year, G7 countries, which include the US and UK, committed to removing “inefficient” fossil fuel subsidies by 2025. The G20 made a similar proposal in 2009, while the World Bank has supported the scrapping of subsidies and the introduction of a carbon tax. Several governments have supported individually the removal of subsidies, including New Zealand, Sweden and Argentina.

There are also large amounts of money involved. The International Monetary Fund estimates that global fossil fuel subsidies, including social and environmental costs, amounted to $5.3tn in 2015, equal to 6.5% of global gross domestic product.

A study from the Stockholm Environment Institute and Earth Track, due to be published tomorrow, finds that 45% of US oil and gas fields can only be developed profitably if they are subsidised. This highlights the role that subsidies play in allowing otherwise uneconomic oil and gas exploitation to go ahead.

However, despite their significance, it can be difficult to measure the volume of global taxes and subsidies. Michael Ross, professor of political science at the University of California Los Angeles and lead author of the study, tells Carbon Brief:

“Some governments announce new policies, but don’t follow through, or negate them, with hidden countermeasures. Or the policies are retracted by the next government. Conversely, other governments will make reforms quietly to avoid opposition.”

The scientists have calculated the changes in subsidies and taxes over time to assess whether governments are ultimately moving in the right direction.

The paper deals only with gasoline subsidies, as this is one of the easier subsidies to track.

Method

To measure the global progress on implementing taxes and removing subsidies, the authors collected local gasoline retail prices for 157 countries from 2003 to 2015. This included all sovereign states whose populations were greater than one million in 2012 (except Cuba, Eritrea, North Korea and Turkmenistan, for which reliable data wasn’t available).

Data was collected from national governments and other bodies, including the European Commission, International Road Transport Union, IMF and World Bank.

Then, the retail price in each country was compared with a global benchmark price. When the price was higher, it meant that the gasoline was being taxed. When the price was lower, it was being subsidised.

This method of measuring means that the subsidy figures they give are likely a low estimate, as it doesn’t take into account what is known as “post-tax subsidies”, says the paper.

Global results

Superficially, this yields a positive picture of global efforts to remove subsidies and tax gasoline. Net taxes rose in 83 countries, while they fell in only 46. The global mean value of each country’s taxation increased by 18.9% over the 12-year period, starting at 42.8 cents in 2003 and rising to 50.9 cents.

However, this doesn’t account for the differing levels of consumption between countries. Ross tells Carbon Brief:

“We find, surprisingly, that even though about two-thirds of all governments having raised taxes or reduced subsidies since 2003, the mean tax on gasoline [when weighted according to country consumption] has been going down — largely because consumption is shifting toward countries where petrol is subsidized or taxed at low levels.”

When countries’ subsidies and taxes were weighted according to domestic consumption, gasoline was still facing a net tax, but the overall sum was lower and had decreased over time. Between 2003 and 2015, it dropped from 27.9 cents to 24.2 cents — a fall of 13.3%.

“This should be a wake up call for policymakers,” adds Ross.

Leaders vs laggards

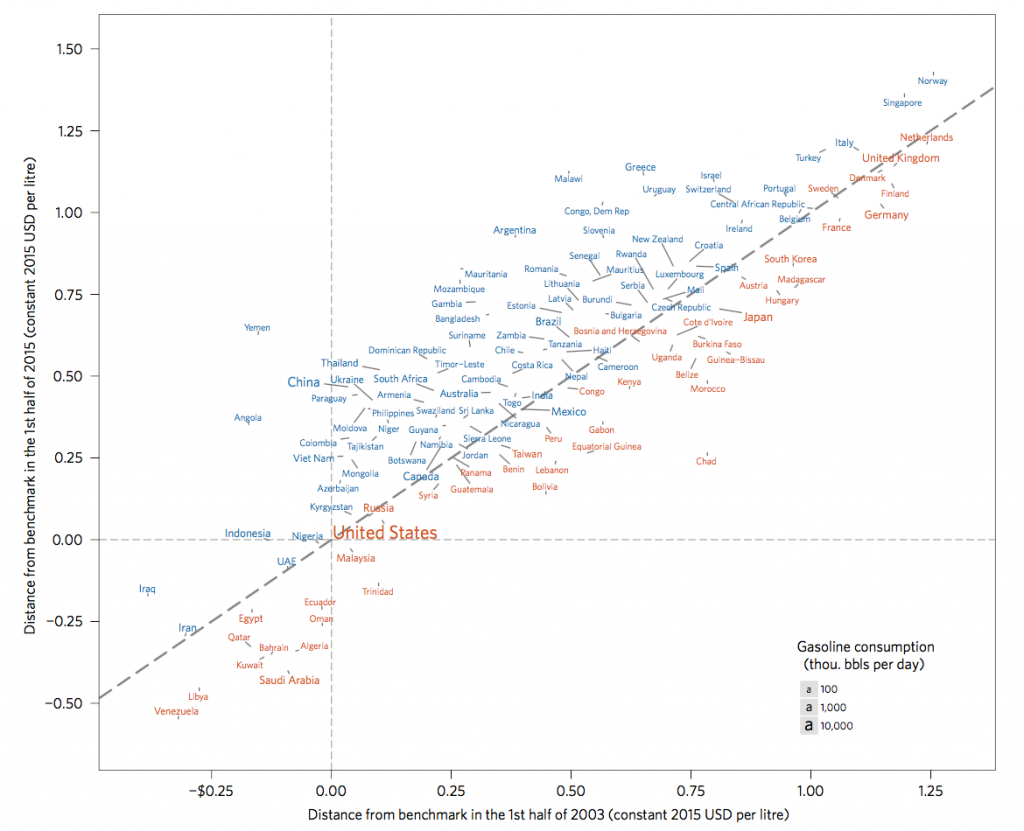

Some nations particularly stood out, either for positive or negative reasons. The following graph shows where each country stood in 2015 compared to its position in 2003.

Net taxes and subsidies by country in 2003 vs 2015. The 83 countries shown in blue increased net taxes or reduced net subsidies over this period, and the 46 countries shown in orange reduced net taxes or increased net subsidies over the period. The lines by each country points to the exact location of the data point. Source: Ross et al (2017)

The researchers calculated that 22 countries were net subsidisers over the period. All of them are economically dependent on oil or natural gas exports — their low gasoline prices reflect political pressure to evenly distribute the resulting revenue, says the study. Ross tells Carbon Brief:

“Venezuela has long had the cheapest gasoline in the world. Even though it raised prices in 2016 (by 6000 percent, for the first time since 1996), after inflation and the currency collapse it (again) sells for about one cent US per litre.”

But it’s not just oil-producing countries that were lagging behind. The authors found no evidence that the G20 countries had acted on the promise made in 2009 to tackle fossil fuel subsidies. Ross says:

“In some ways, the most egregious laggard is the US: the federal gasoline tax is just 6 cents a litre and has not changed since 1993.”

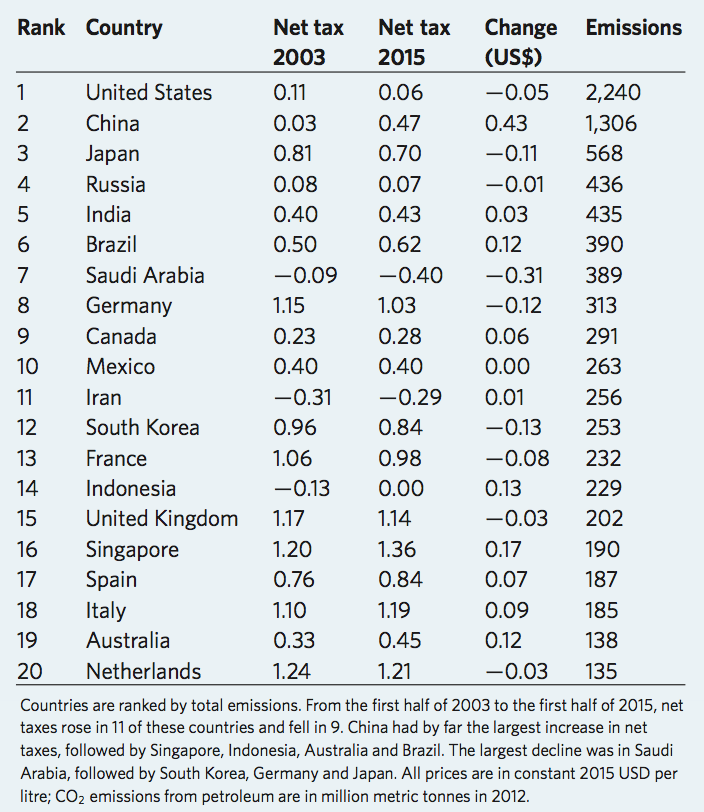

The UK is among the countries that lowered its tax on gasoline over the period, from 1.17 cents in 2003 to 1.14 cents in 2015. The table below shows net taxes for the 20 largest emitters of CO2 from petroleum consumption.

Changes in net taxes for the 20 largest emitters of CO2 from petroleum consumption (including gasoline and diesel). Source: Ross et al (2017), EIA data

Other countries made good progress in increasing taxes over the period measured. Ross says:

“The countries with the biggest increases were in Argentina, China, and Malawi, surprisingly. Among the large emitters, China’s reforms were remarkable.”

09.01.2017

SOPHIE YEO

Originally published in Carbon Brief

Be the first to comment on "World is ‘backsliding’ on gasoline subsidies, finds study"