This is part 3 of a three part series. See here for part 1 and part 2.

Looking for belief in the history of technology development is like looking for the seat of consciousness in the brain. We can take the brain apart, neuron by neuron, and ask what each cell does. But nowhere in the system do we get a sense of how they work together; of what makes this warm, pink jelly a soul.

Similarly, the industrial and logistics improvements that make a technology cheaper seem dry, deterministic, and inevitable. But none of them had to happen today. It is speed, not engineering alone, that wins markets. It is speed that transforms civilization.

And when customers and suppliers move in rhythm, it’s astonishing how quickly a technology can grow.

Boeing B-17Es under construction. Boeing exceeded its (already) accelerated delivery schedules by 70 percent in the month of December 1942. Photo: US Air Force, via ww2today.com

Theodore Wright, at war

“We won because we smothered the enemy in an avalanche of production, the like of which he had never seen, nor dreamed possible.

William Knudsen, Former President of General Motors (1937-1940) and Chairman of the Office of Production Management (1940-1942)”

In 1938, the Roosevelt administration started a quiet study of the capacity of the US aircraft industry. The Great Depression still cast its shadow on investment, and aircraft manufacturers were far more concerned with staying solvent than the remote possibility that war would overfill their factories. Expansion would be welcome, someday, but they had more immediate problems to consider.

But war was brewing. Roosevelt’s military was on edge, and in 1939 commissioned the “Yardstick Board” to develop an understanding of the limits to the growth of US air power. Different methods had been developed to capture the production capacity of American industry, such as the dollar value of production, the number of planes produced, or the square footage of production space. It was not clear which was best.

One engineer, however, had actually thought about the question in depth before: Theodore Wright. In trying to answer a question about the costs of flying cars, Wright had inadvertently answered Roosevelt’s most important question in preparation for war: can US industry handle the expansion of production needed to defeat the Germans and Japanese?

From 1938 to 1941, US production of airplanes had grown quickly, but it had never more than doubled on a yearly basis. In 1941, with war at hand, Theodore Wright resigned from the Curtiss-Wright Aircraft Corporation to become Assistant Chief of the aircraft section of the Office of Production Management, a newly formed body dedicated to converting US industry from civilian to defense production.

At the start of WWII, before 1940, the US produced 3,000 aircraft per year for defense purposes. In 1944, it produced 100,000.

Technological trends alone would tell you nothing of what to expect for war. To understand what is possible, you also have to track belief.

A change of belief

Doubt will hold back the pace of technological change, as much as science or economics. In war, there was no uncertainty of whether production would be procured. The only focus was how to make more, faster.

War required rethinking previous trends – it was no longer relevant to draw a simple line based on the past cost of a plane. Belief that goods would be purchased meant that a supplier could accelerate investments in capacity. Belief in the supplier meant that manufacturers could ramp up their own production, and drop their own costs. A change of belief leads to a change of behavior.

Theodore Wright and his team developed sophisticated statistical tools to plan for mobilization, analyzing every raw and finished material that contributed to a product’s costs – the first use of robust statistical modeling in government. From here on out I will make some very broad predictions, without the benefit of Wrights data, team or skill. But while predictions always carry a hint of danger, today’s solar prices put us indisputably on the cusp of change.

As solar crosses the threshold where it is cheaper than coal, the entire supply chain will believe. Risks will fall. Certainty drives investment, and investment drives costs. And with each drop in price, a new region of the globe will become profitable for solar. A new region will abandon coal for cheaper energy. And the cycle will accelerate.

If we assume that energy is 10% of the world’s $75 trillion economy, then the long-term available market for solar is $7.5 trillion dollars. The most comparable market is the world automotive market, where today’s investors see ride-hailing services and self-driving cars as a potential replacement for vehicle ownership. Venture capitalists and investment funds have pumped billions of dollars per year to lower the prices of Uber, Lyft, Didi Chuxing, Ola, and other similar companies around the globe, even though they all lose money on each ride. It is worth the losses today to build scale in such a colossal, accelerating market.

The sensible strategy today for solar companies is to invest everything they can in scaling, profit be damned. Price drops could continue for a while.

This would not only be a sound investment; it would be a boon to the world. We may not get a WWII era type increase in solar production, but business logic says, at minimum, we have little reason to expect the price drops to slow.

And that leads to some very interesting inferences.

Image from How Predictable Is Technological Progress?, JD Farmer and F Lafond, Research Policy 45(3), 2016

Energy

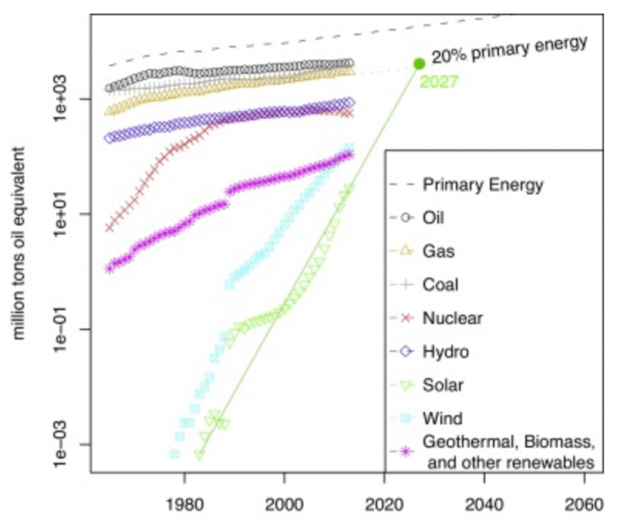

Solar represents only a little over 1% of energy production today. Yet if you extrapolate solar’s current rate of growth out 10 years, you get big surprises.

The first is that solar could be as large a contributor to energy production as oil. Not in 2100 or 2050. But by the time today’s 6th graders finish college. If they apply themselves.

And based on our recent experience with solar, that simple extrapolation is likely an underestimate.

You may have heard that it’s not possible to fit this much renewable energy onto the grid – it will collapse because of the “intermittency” problem (solar production drops when a cloud passes, and disappears entirely at night). But if you ask utilities exactly how much solar can be tolerated, the answer gets squishy. New technologies make the grid more flexible. New business models more efficiently allocate demand. How much intermittency might be tolerated if the price is right? How hard will utilities work to accommodate solar if they believe customers demand it?

There are voluminous engineering objections to solar – specific problems that impede us, specific behaviors that bind. Their specificity persuades, as does our inability to match them detail for detail with a solution. But the history of technology – semiconductors, airplanes, solar – is a history of excavating barriers spoonful by spoonful, shovelful by shovelful, until a path through is cleared. The burden should not be placed solely on optimists to circumvent obstacles not yet encountered. Burden should be placed on skeptics, to explain why this time is different.

Moore’s Law was supposed to end in the early 2000s, when the ‘diffraction limit’ ended the usefulness of lithography. It didn’t. As a young engineer, I vividly recall telling managers that the thing they asked for couldn’t be done, only to come back the next morning with a solution. Physical, scientific barriers do indeed exist. But the vast majority of barriers are in our imaginations.

The economics of solar will convert the world’s utilities from skeptics to believers, and their engineers will do what engineers do best: invent, improve, and deploy new technologies. Meanwhile, wind – which is right now even cheaper than solar – moves forward on a similar curve. Though it is not improving at quite the torrid rate of solar, wind is on track to contribute another 20% of global energy by 2027.

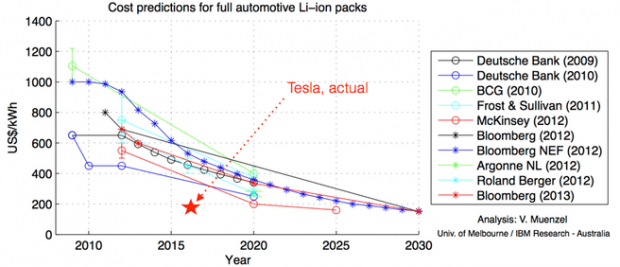

And batteries – which are needed to store all this solar and wind energy if we are going to maximize use of it – barrel down their own experience curve. The trend might look familiar.

A collection of analyst predictions for battery costs, from theconversation.com (2014), annotated with Tesla’s actual 2016 costs.

Analysts generally claim that a battery powered car will have to be $100-$150/kWh to compete with gasoline. Prior to that, they make no economic sense.

Academic and industry analysts have claimed that pricing will be >$200 per kWh even in 2020; at this cost, batteries can’t materially change our energy future. Yet Tesla announced in the beginning of 2016 – before their new Gigafactory became operational – that they were already below $190/kWh. And world battery capacity is expected to increase more than six-fold in the next four years, with most made by Chinese companies unknown to the average American. The Holy Grail of $100/kWh could be in reach by 2020.

Batteries, like solar, have been carried by hippies to the threshold of economical sensibility. I don’t have enough data to predict how fast prices will fall, or when they will materially change the world’s energy grid. But the economic threshold is nigh; yesterdays trends provide a minimum expectation, not a maximum. The fall may happen much faster than experts anticipate.

The planet

Does this mean we can stop worrying about climate change?

The Earth is warming, and we are causing it. The temperature increase is about 1°C so far, and with each increment we melt a little more ice, and chase another bird a little further up the mountain, until it can fly no higher.

Graves like these lie all along the road to ruin, yet there are some larger markers as well. The irreversible melting of Greenland’s ice sheet could occur with as little as 1.9°C in warming, leading to ruinous sea level rises. This, along with the Round Number Theory of Policy, is what drives the Paris Agreement to herd countries towards a commitment to cap global temperature increases at 2°C.

Right now, we’re far from redemption. Current commitments, established in 2015, would limit global temperature rise to 3°C, a level at which the world’s coral will bleach, and coastal cities will drown. Yet as India’s example has shown, the growth of solar will immediately weaken that threat. A path to 2°C becomes clear.

But a prudent person would note that 2°C is still greater than 1.9°C, and the cost of missing the mark on polar ice melt – climate predictions are inexact to say the least – is a mind-bending actuarial risk. This is why the Paris Agreement also specifies a preferred, more aggressive target of 1.5°C.

To keep the planet to just 1.5°C in temperature increase, we will have to hustle, even under the most optimistic scenarios. We will have to give up coal in most developed nations by 2030. Use of gasoline automobiles will have to cease by 2035. And we will have to create some new, yet-to-be-invested technology to sequester the carbon we’ve already emitted from the air.

Which is to say, it’s just barely possible. And with the rapid rise of solar, and of batteries, it might even be economical.

But we still need a modern Theodore Wright to show us how.

Jean Carlu WWII Propaganda poster. Image: Wikipedia

The power of belief

Political beliefs describe the paths we want, tomorrow. But technological beliefs show us the paths that are, today.

Only when the engineering is moving quickly can the technological leap so far ahead of the political. Yet as Greenpeace’s underestimates of solar show us, that’s unquestionably the case today. What’s needed now is not to cram solar down the throats of those who object. What’s needed is to show them how to believe.

When consumers believe that solar will give them cheaper rates, they will demand it from utilities. When utilities believe their customers are right and righteous, they will demand their engineers prepare for it. When the engineers start to upgrade the grid, reducing the costs of getting intermittent energy onto the system, the makers and installers of solar panels will know it is time to scale. They will cut costs, and ask for cuts from their suppliers. And the cuts will come.

Technological change starts with belief.

China has an edge on us in harnessing cheap solar energy. This is not because China is cheating, or somehow using their home-grown solar capability for themselves first. They simply believed before we did.

The US has time to catch up, but first must leave behind its fervent skeptics – those who refuse to believe in solar, simply because. Economic skeptics will still find it hard to throw off their politics for the practical, but money has a way of incentivizing change. And the money is ready.

With prices falling as they are, industry will tip quickly, perhaps even inside the timescale of a presidential term. Changes in energy are happening faster than changes in politics. And the louder we clamor for it, the faster the change will come, and the faster we will benefit in every way possible. We can save the planet, and build a richer world.

Believe, and you help make it happen.

Originally published by Perspicacity.xyz