Ten years ago, carbon capture and storage or ‘CCS’ went hand in hand with the idea of ‘clean coal’. Although early efforts to capture CO2 emissions and store the greenhouse gas deep underground had mostly taken place in other industries, coal power’s enormous contribution to global carbon emissions was seen as the obvious grand prize for this ambitious climate change-mitigation technology. At the time, governments interested in CCS, such as the US, Canada, Australia, and the EU, led a host of projects aimed at developing CCS for their own coal fleets, as well as attempting to launch projects in China.

Ten years ago, carbon capture and storage or ‘CCS’ went hand in hand with the idea of ‘clean coal’. Although early efforts to capture CO2 emissions and store the greenhouse gas deep underground had mostly taken place in other industries, coal power’s enormous contribution to global carbon emissions was seen as the obvious grand prize for this ambitious climate change-mitigation technology. At the time, governments interested in CCS, such as the US, Canada, Australia, and the EU, led a host of projects aimed at developing CCS for their own coal fleets, as well as attempting to launch projects in China.

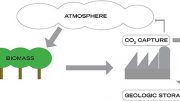

Now, following years of mostly disappointing progress, interest in CCS has reignited in several countries, but it is much less frequently linked to coal power. Many advocates for the technology argue that it should be reserved for cleaning up emitting industries, which can’t be helped by renewable energy, such as steel and cement, or used to help achieve ‘negative’ CO2 emissions by storing CO2 produced from bioenergy.

This is arguably an exercise in rebranding; after years of failing to gain meaningful government support, and dogged by accusations of serving merely as a fig leaf for an irredeemable coal industry, many CCS supporters tacitly acknowledged that any association with coal was not helping the case. As a result of this shift in narrative, the coal mining companies still backing CCS as representing a clean future for their product have become somewhat isolated from the rest of the CCS community, and more subject to accusations of ulterior motives than ever.

A recent Financial Times article scrutinising the CCS-promoting activities of Australian coal-mining giant Glencore is indicative of this trend. Although seeking to present a balanced view, the piece draws heavily on ardent critics of CCS, whose views are as deserving of scrutiny as those of Glencore. Coal power remains the world’s single largest source of electricity, and the biggest contributor to CO2 emissions; it is therefore inevitable that its role in our efforts to decarbonise is more nuanced. It is true that the case for deploying CCS on coal power is diminished in some regions from ten years ago.

The article cites the well-known cost reductions in wind and solar power, which have made some forms of those technologies cheaper than coal in several parts of the world. Perhaps more importantly, there has been a marked shift from coal to gas power in many Western economies, particularly in the US and the UK, driven by cheap gas or high carbon prices. In these countries, where building things is relatively costly, the capital required for large coal plants can also sometimes outweigh any fuel savings made over more compact gas plants.

However, Glencore does have some important numbers on their side. The company regularly turn their detractors to the role of CCS in decarbonisation pathways produced by the International Energy Agency (IEA) or the Intergovernmental Panel on Climate Change (IPCC). These organisations run computer models which seek to determine the lowest cost route to achieving targets such as limiting global warming to 2°C or 1.5°C in the next few decades.

Despite huge growth in renewable generation in all these pathways, CCS still features heavily, and a significant proportion of it is still on coal power. How does this square with its newly acquired status as a worthless anachronism?

The IEA’s most recent Sustainable Development Scenario, consistent with keeping global warming to ‘well below 2°C’ features 210 GW of coal power fitted with CCS by 2040, mostly in China and the US, along with 169 GW of gas power with CCS. More detailed IEA analyses typically show CCS must capture similar amounts of CO2 from the power sector as it will from all other industries combined.

These results stem fundamentally from two basic facts: firstly, there is an enormous amount of coal power plants around at the moment, half of which are less than 15 years old; secondly, even if there were some prospect of closing these plants early (unlikely in energy-hungry countries like China and India), completely replacing thermal power plant is not so straightforward.

While the Financial Times article makes much of the decline of coal in the UK, less is said about the country’s continued interest in gas power with CCS, with a few government-backed projects currently in various early stages of development.

This is illustrative of the difficulty in achieving a zero-carbon energy sector with renewables alone, as wind and solar power do not generate all the time, and require some kind of back-up for when they do not.

And while gas power with CCS is now more economical in much of the West, for Asian countries, where gas is expensive and capital cheap, coal power with CCS comes out on top. Climate models do not care that the gas plant started off slightly cleaner than the coal plant: once fitted with CCS, they produce equivalent low-carbon energy.

This kind of argument for retaining some form of ‘dispatchable’ back-up power plant is usually met with appeals to the rise of energy storage technologies, and the falling cost of batteries in particular. To make this point, the Financial Times article, unfortunately, refers to dubious cost figures from a US-focussed 2018 report on CCS by the Institute of Energy Economics and Financial Analysis (IEEFA) – a group with a mission to accelerate a specific form of energy transition rather than the academic institute that their name suggests.

The report cites bids made in recent US auctions for power purchase agreements (PPAs) for new ‘solar and storage’ ($35/MWh) and ‘wind and storage’ ($21/MWh) projects in Indiana and Colorado respectively. Such low bids are impressive and positive news, but these projects are not equivalent to a CCS power plant. They typically relate to a renewable plant with some battery capacity to help with grid stability and to better match generation to peak demand. This does not mean that power is available whenever required. Such competitive prices are also based on projects receiving capacity payments and federal subsidies for wind and solar, such as production and investment tax credits.

In its latest ‘World Energy Outlook’ the IEA cautions against the use of PPA auctions as a general indicator of renewable costs, and gives a figure of around $80/MWh as a ‘world average cost’ for solar power with favourable financing conditions. Perhaps most telling in the US context is the fact that conventional fossil plant is still very much alive, in the form of natural gas power plants which represented over 60% of new generating capacity in 2018.

Several of the contributors to the Financial Times article appeal to a widespread but rather circular argument that CCS should not be pursued because it has so far been deployed at such small scales. There are only two coal plants currently operating with the technology, and even these are decried for being smaller than the largest power plants.

The piece strikingly illustrates the poor progress with a graphic contrasting the emissions captured in one year by the existing Boundary Dam CCS coal plant in Canada (626 thousand tonnes) with the 10 billion tonnes emitted annually by coal power worldwide (nearly a third of all CO2 emissions).

Leaving aside the puzzling omission of a second, much larger CCS coal plant operating in Texas, this comparison should serve only to remind us that most efforts to reduce CO2 emissions appear a drop in the ocean compared to the immense scale of the challenge the world faces, even for comparative success stories like the rapid growth in solar power.

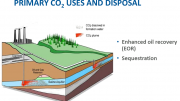

In 2017, there were 460 TWh of solar power generated worldwide; if we assume that this renewable power has replaced the same amount of gas-fired generation, it has avoided only around 180 million tonnes of CO2 (or around twice this amount if we assume coal is replaced). This is less than five times the total emissions captured by the handful of CCS plants currently operating in all industries – remarkably similar figures for technologies with ostensibly such varying fortunes.In reality, the failure of CCS deployment to snowball in the same way as wind and solar power is evidence of nothing more than the lack of money to be made in storing CO2. The two technical demonstrations in Canada and Texas, have shown that it is entirely feasible to capture and store CO2 from coal plants, but both rely on using the gas to boost oil-field production for it to make some kind of commercial sense.

IEEFA condemns this practice in the Financial Times piece, yet it is merely filling a gap where government incentives would normally have to play a role. The remarkable growth in wind and solar power has thus far been driven not by their low cost, but by government subsidies which have then been rewarded by falling costs. This kind of positive feedback can also occur for CCS, and may do so in the US now that the government has introduced a new tax credit for storing CO2.

Arguably, opponents of the use of CCS on coal power specifically are left with a more problematic position than those who oppose the technology outright. If one accepts the models showing an urgent need for CCS, then one must also accept the important role shown for it in the coal sector, regardless of any personal distaste for the black stuff. And if the – admittedly formidable – task of building a large-scale infrastructure for collecting and storing CO2 is to be embarked upon, it would be odd not to use it to address power plants.

The shift in CCS dialogue away from coal can be partly attributed to a Western-centric view that gas is visibly replacing coal anyway, but in Asia and many other parts of the world, coal continues to dominate and other approaches are needed.

While Glencore’s motivation for backing CCS is doubtless not purely motivated by concern for the planet, this does not in itself mean that the arguments they present are without merit. Reducing our carbon emissions to the levels required is a gargantuan task, and will require much greater use of all the options available to us if we are to have any chance of succeeding.

Toby Lockwood