For over a decade Pakistan’s growing economy has been held back by a chronic shortage of electricity; supply has often fallen short by over 20% as roll-out of new power plants persistently lagged behind a rapid growth in demand. This situation has now begun to change fast, with several new power plants coming online in the past year and many more under construction or planned.

For over a decade Pakistan’s growing economy has been held back by a chronic shortage of electricity; supply has often fallen short by over 20% as roll-out of new power plants persistently lagged behind a rapid growth in demand. This situation has now begun to change fast, with several new power plants coming online in the past year and many more under construction or planned.

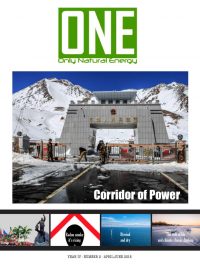

Driving the change is a massive influx of Chinese investment and engineering expertise known as the China-Pakistan Economic Corridor (CPEC) – a grand vision to connect Western China to the Arabian sea by modernising Pakistan’s energy and transport infrastructure.

Closely related to China’s ‘Belt and Road initiative’ which is investing in infrastructure and trade links throughout Eurasia, the main focus of CPEC is to provide China with a fast connection to Pakistan’s deep water port at Gwadar, but the $62 billion worth of projects also encompasses over 16 GW of new generation capacity in the energy sector. Still more Chinese investment, through export credit agencies and development banks, is flowing into Pakistan’s energy sector outside of the official umbrella of CPEC, carrying similar obligations to use mostly Chinese equipment and engineering.

Pakistan’s historic power generation problems have been exacerbated by an unusual reliance on burning the petroleum product ‘fuel oil’ in many of its power stations, making up around a third of its electricity supply in 2015. More expensive than gas and as dirty as coal, this liquid fuel has widely fallen from favour as a way to generate electricity outside of oil-rich states and small islands. As a relatively small-time oil producer, Pakistan has relied on imports to feed its power plants, and began to feel the pinch when oil prices soared in the 2000s.

Hydroelectric plants in the country’s mountainous north provide another significant contribution, as well as some gas and nuclear plants, but coal – the cheap fuel of many a developing nation – is conspicuously absent from the mix. Pakistan discovered vast coal reserves in the Thar desert in the early 90s, but has been slow to exploit the resource, while sometimes using it as a barganing chip in climate negotiations. Thar coal is the watery, low-energy variety known as lignite, which is not worth transporting any distance, but is mined worldwide in huge opencast pits and fed directly to nearby power stations.

Coal will be the biggest winner from China’s investment, as over 10 GW of Chinese-built coal power plants are deployed over the next few years, and nearly all of them feature on CPEC’s list of priority projects poetically known as the ‘early harvest’. The Thar coal field has been divvied up between a handful of new companies formed by Pakistani and Chinese investors, and one power plant is already under construction.

However, even further ahead are coal plants elsewhere in the country which do not exploit Pakistan’s resource at all, instead relying on shipments of coal from Indonesia and South Africa. Two of these, one in the port of Karachi and one in Punjab are already operating, and another in the western province of Balochistan is set to be completed next year. While these projects can move faster without having to rely on construction of the new mines, there is some political dissent over the country taking the proverbial coal to Newcastle rather than drawing on its own natural wealth. Provincial tensions have also come into play, with regions such as Punjab keen to secure their own power plants rather than relying on electricity transmitted from the new coal fields.

Exploitation of the Thar coal fields is mired in controversy over its potential environmental and social impact. Local villagers have taken the Sindh Engro Coal Mining Company to court in protest against an enormous (600 hectare) reservoir needed to contain effluent from the mine, which they fear may contaminate their land and water. The company maintain that the area will be fully rehabilitated following the mining, and have sought to appease residents with an elaborate corporate responsibility campaign, including new homes, schools, a hospital, and pledges to hire locally. On an international level, the high CO2 emissions inextricably associated with the use of such low-grade coal has also sparked the concern of climate activists, and it is suspected that climate concerns were a significant factor in the withdrawal of the World Bank from the project in 2009. While the bank gave more prosaic financial reasons for its exit, it has since hugely reduced coal project financing, joining other major development banks such as the European Investment Bank; such environmental scruples do not tend to pose a problem for the Chinese lenders.

Nevertheless, China leads the world in deployment of renewables as well as coal, and these cleaner energy sources have not been ignored by CPEC. The 1000 MW Quaid-e-Azam Solar Park will become one of the world’s largest solar power plant when it is completed later this year, 250 MW of wind farms have already sprung up, and three large hydroelectric projects are scheduled to start generating in the early 2020s. Although mostly outside of the sphere of CPEC, Chinese investment is also seeking to play a role in the ongoing expansion of Pakistan’s infrastructure for importing liquefied natural gas (LNG), but faces much fiercer global competition in a sector fraught with geopolitical complications.

Plans to construct an Iran-Pakistan gas pipeline have long been on hold due to international sanctions on Iran, while US pressure has favoured LNG ship terminals for imports from Qatar. China had backed a pipeline to the port of Gwadar (which lies close to the Iranian border), with the option of eventually connecting to the Iranian pipeline, only for Pakistan to abandon the plan last year in response to US and Saudi pressure. Undeterred, China has sought to become involved in Russian-led plans to build another pipeline north from new LNG terminals in Karachi. This pipeline would help fuel three state-of-the-art gas power plants in Punjab, recently completed by Chinese engineering contractors using GE equipment.

This rapid growth in Pakistan’s power generation capability may turn the energy shortage into a surplus by the end of 2018, but it has not been without criticism. Many commentators in Pakistan have urged for a slowdown and rethink of the country’s energy priorities, either to reduce dependence on imported gas and coal, or to shun Thar coal in favour of cleaner, renewable energy. However, with Pakistan’s per capita energy consumption still a fraction of the global average, and the International Energy Agency forecasting a doubling in demand by 2025, it seems likely that the Chinese power projects will fulfil a real need. CPEC and the far-reaching Belt and Road Initiative have come under suspicion as a means of expanding China’s political influence among its neighbours and beyond.

On a more practical level, international infrastructure projects are providing an outlet for China’s vast engineering and construction capacity, as the frantic modernisation of China itself subsides. Whatever the primary motivation, it is clear that CPEC represents just one story in a key trend for energy financing in the developing world: the influence of multilateral development banks is receding, to be replaced in part by Chinese institutions with much less-demanding criteria for environmental protection or market reform.

Toby Lockwood